B4 CoPilot Pro v8 + B4 Footprint Pro

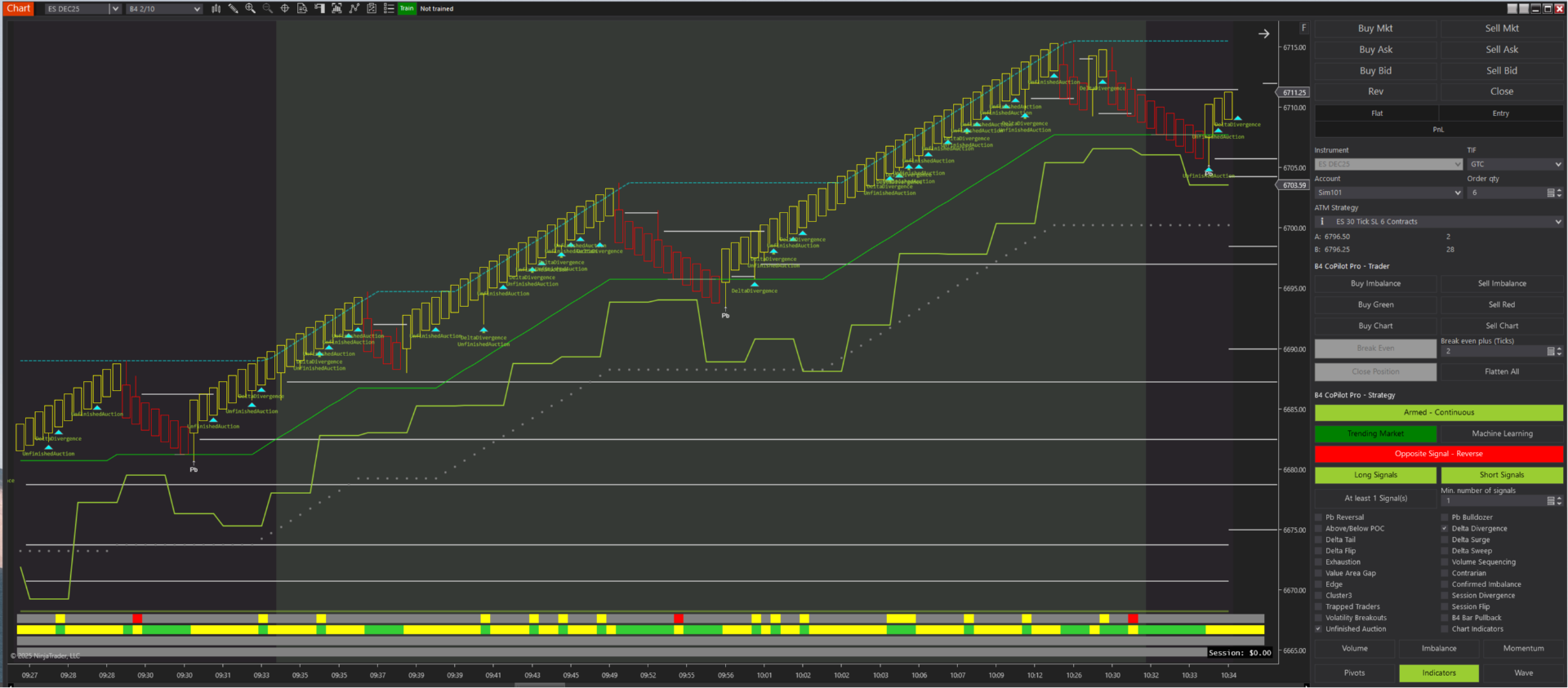

Experience next-level trading precision with B4 CoPilot Pro v8 and B4 Footprint Pro. v8 builds on everything you relied on in v7—auto order placement, Chart Trader execution, and smart filtering—while adding visual signal detection from 3rd-party indicators for seamless backtesting and full API integration for B4 Wave and B4 CVD signals, ready to plug directly into your strategy.

B4 Footprint Pro enhances your market insight with high-resolution order flow analysis, VPOC Automatic levels, and our proprietary liquidity and exhaustion detection. The combination of CoPilot Pro v8 and Footprint Pro gives you the ultimate edge: automate, analyze, and execute with confidence, staying aligned with the real-time pulse of the market.

B4 CoPilot Pro v8 Automated

Automated Order Flow Trading with L2, B4 Footprint Pro, and B4 Wave/CVD Integration

The Ultimate Evolution in Trading.

See pricing

The Ultimate in Automated Order Flow

B4 CoPilot Pro V8 — Overview

B4 CoPilot Pro V8 is the strongest version of our automated order-flow engine to date, engineered for precision execution, deeper order-flow context, and smoother NinjaTrader integration. V8 builds on the proven foundation of V6 and V7 with faster processing, expanded filters, cleaner automation, and the new On-Screen Recognition API that ties directly into the B4 Footprint Pro ecosystem.

Advanced Order Flow & Level 2 Integration

V8 refines how traders see and act on real-time order flow.

-

22 order-flow signals with lightning-fast internal processing

-

Enhanced Level 2 depth integration (data purchased separately)

-

Upgraded Indicators filter, allows 3rd party integration with your personal indicators

-

On-Screen Recognition API for real-time visual cues

Execution, Risk Management & Automation — Upgraded for V8

The execution engine has been tightened to respond faster and operate more consistently during volatility.

-

Automated order placement directly from the chart

-

ATM-based stop-loss and target management

-

Superior break-even logic that adjusts more smoothly to volatility

-

Long/short toggling with cleaner directional filtering

-

Expanded criteria controls for signal sequencing and confirmations

Visual Mapping, Trend Tools & Backtesting Enhancements

V8 improves clarity and context so traders can make faster decisions.

-

Visual trend mapping with refined directional cues

-

Customizable background responses tied to real-time signals

-

Faster backtesting engine for tuning entries and filtering noise

-

On-Screen Recognition overlays that highlight active order-flow behavior

Streamlined Interface & Operator Controls

The interface in V8 is built to eliminate friction and improve workflow.

-

Fully collapsible panels for a cleaner workspace

-

Adjustable fonts and signal display controls

-

Seamless integration with NinjaTrader Chart Trader

-

Diagnostic overlays showing what CoPilot is detecting in real time

B4 CoPilot Pro V8: Precision Automation for Real-Time Order Flow

V8 pushes automated order-flow trading into a new tier of performance. With the new On-Screen Recognition API and a refined execution engine, CoPilot Pro V8 delivers a faster, cleaner, and more decisive trading experience built for today’s futures market.

V8 also expands the ecosystem: B4 Wave and B4 CVD are now fully integrated through our API, operating as native family add-ons. They plug directly into CoPilot’s automation logic, giving traders deeper momentum context, clean cumulative volume confirmation, and a unified decision engine that reacts instantly as conditions shift.

This is the upgraded B4 suite — connected, tuned, and ready to trade.

Revolutionary Level 1 & Level 2 Data Filtering — Move in Sync With the Market Makers

The L1/L2 filtering engine in B4 CoPilot Pro V8 remains one of the strongest advantages in the platform — delivering the speed, clarity, and responsiveness traders need to track real-time liquidity with confidence.

The Power of True L1 & L2 Delta Insight

This filtering exposes the market’s real heartbeat:

-

L1 Delta shows where aggressive orders are actually hitting the tape.

-

L2 Delta reveals the deeper intentions of resting liquidity.

Together, they give traders a live read on where size is hiding, where it's shifting, and where the market is likely to pivot before the crowd reacts.

Stay Aligned With the Players Who Move the Market

This is how traders avoid traps and stop trading blind:

-

See when large players absorb vs. push

-

Spot hidden walls before they vanish

-

Track sentiment and passive liquidity in real time

-

Position with intent instead of reacting to noise

These filters keep traders synced to the same rhythm as the liquidity providers — not fighting against them.

A Proven Edge, Elevated Inside V8

With refined processing and sharper visibility throughout the platform, CoPilot Pro V8 brings even more precision to the L1 and L2 Delta edge traders rely on.

B4 CoPilot Pro V8 makes the market makers’ activity unmistakable — and actionable.

Order Flow Signals — Navigate Market Movements With Confidence

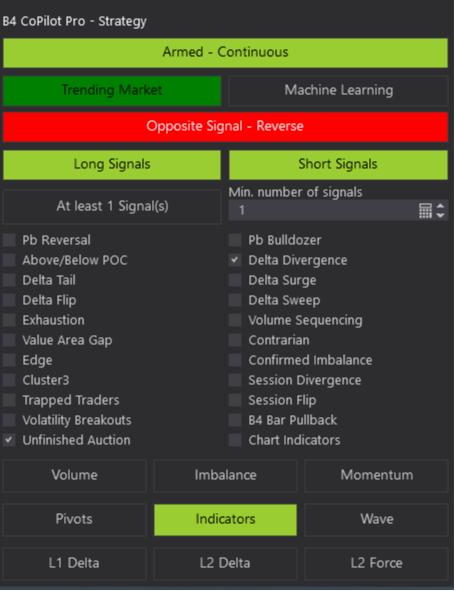

B4 CoPilot Pro V8 delivers the complete suite of industry-standard and proprietary order-flow signals the B4 community relies on, now running with V8’s improved responsiveness, cleaner processing, and unified ecosystem integration. This lineup gives traders the clarity, precision, and flexibility to read the market with confidence — whether they trade trend, momentum, pullbacks, or reversals.

Industry-Standard Order Flow Signals

V8 maintains full support for the essential signals traders expect, enhanced by smoother internal processing and cleaner chart interaction.

-

Above/Below POC: Tracks positioning around the Point of Control for trend conviction and potential reversals.

-

Delta Signals: Delta Tail, Delta Flip, Divergence, Delta Surge, Volatility Breakouts, and Sweep — revealing pressure shifts and aggressive flow.

-

Cluster3: Detects concentrated bursts of buying or selling that often precede breakouts or strong continuation.

Pullback Series: Pb Reversal & Pb Bulldozer

These signals remain core tools for trend traders:

-

Pb Reversal: Marks the likely end of a pullback, signaling continuation.

-

Pb Bulldozer: Identifies powerful momentum pushing through key zones.

Together, they give traders clear, high-probability pullback entries with controlled risk.

Proprietary V7+ Signals — Fully Integrated Into V8

CoPilot Pro V8 carries forward all advanced B4 signals, each now running inside the updated V8 engine.

Unfinished Auction

Points to areas where the auction failed to complete — imbalanced extremes that often become magnetic in future price action.

Chart Indicators API Integration

Your own logic, your own conditions — now recognized natively inside V8.

-

Accepts external logic via the B4Indicators.com API

-

Supports strategy-driven, condition-based, or filter-based signals

-

Fully compatible with CoPilot Pro and Chart Trader execution

-

Ideal for merging discretionary rules with B4 automation

Existing B4 Proprietary Signals

Proven, reliable, and exclusive to the B4 ecosystem.

-

Trapped Traders: Reveals trapped participants and potential reversal pivots.

-

Session Flip: Captures powerful transitions between sessions.

-

Volatility Breakouts: Identifies volatility expansions that commonly lead to directional runs.

-

B4 Bar Pullback: Highlights structured pullbacks within B4 Bar setups.

-

Contrarian & Confirmed Imbalance: Surfaces real-time imbalance shifts and reversal conditions.

-

Exhaustion: Marks fading pressure as trends reach their limits.

-

Edge: High-probability entry and exit points derived from advanced order-flow modeling.

A Complete Signal Engine — Now Elevated in V8

CoPilot Pro V8 gives traders a fully customizable signal environment: mix, match, filter, or automate. Every signal flows through the updated V8 engine for sharper clarity, cleaner execution, and seamless integration across the B4 trading ecosystem.

With V8, traders navigate market movement with confidence — powered by the most versatile order-flow signal suite in the industry.

See pricingAdvanced Machine Learning. Robust Analytical Performance.

B4 CoPilot Pro v7 enhances its machine learning engine, building on the foundational improvements made in version 5. This evolution ensures that the system adapts seamlessly to the ever-evolving dynamics of the markets, providing traders with a robust analytical tool tailored for optimal performance.

Advanced Filtering and Signal Capabilities:

- Introduction of advanced filtering options expands the breadth of available signals.

- Traders can leverage a comprehensive suite of filters, including the L1 Delta filter alongside various others such as Volume, Imbalance, Momentum, Pivots, Indicators, and Wave.

This integrated approach empowers traders to fine-tune their trade criteria, ensuring they receive the most relevant signals for their specific strategies.

Adaptive Learning Algorithms:

- The machine learning engine employs adaptive learning algorithms that continuously analyze market conditions and trader behavior.

- This adaptability allows the system to learn from past performance, dynamically adjusting its signal generation and filtering processes to align with current market trends. Our algorithm intelligently selects the optimal combination of signals and filters from your chosen options to deliver the best possible results.

Threshold-Based Trending & Regression Trade Differentiation:

- When machine learning is enabled, the system utilizes defined thresholds to differentiate between trending and regression trades.

- The Trend Entry Ratio identifies when trades should align with the prevailing market trend, allowing execution when market conditions exceed this ratio.

- The system initiates trades in the opposite direction when conditions fall below the Ranging Entry Ratio, effectively capturing regression or counter-trend opportunities.

- This sophisticated approach enables traders to adapt their strategies based on current market dynamics, enhancing their ability to make informed trading decisions.

The machine learning refinements in B4 CoPilot Pro v7, particularly through the integration of advanced signal and filtering capabilities, represent a significant advancement in trading technology. By combining these elements, traders are empowered to navigate complex market environments with greater confidence and precision.

See pricingRedesigned Chart Trader Interface. Quick & Precise Trade Execution.

Our redesigned Chart Trader interface is built for quick and precise trade execution, while placing a strong emphasis on advanced risk management—helping traders maintain control and make informed decisions in dynamic market conditions:

Buy Imbalance & Sell Imbalance: Trade at imbalance zones in order flow to capitalize on shifts in liquidity.

Buy Green & Sell Red: Execute trades at candle closes for confirmation-based entries.

Buy Chart & Sell Chart: Set resting buy or sell orders with a single click, streamlining entry placement.

Enhanced Risk Management: Features like the Breakeven Button, Close Position, and Flatten All make managing trades more efficient.

With the upgraded Chart Trader interface, intuitive trade execution is just a click away.

See pricingEnhanced Dynamic Customization. Trade Execution and Visual Testing.

✔ Dynamic Signal Selection: The enhanced customization feature allows traders to choose from a variety of order flow signals. By selecting their preferred signals, users can focus on the indicators that resonate most with their trading style, enhancing their overall strategy.

✔ Real-Time Adjustments: With the ability to customize execution rules based on live market data, traders can make real-time adjustments to their strategies. This responsiveness allows them to capitalize on emerging opportunities and mitigate risks more effectively.

✔ Real-Time Visual Backtesting: Visual feedback on signal combinations enables traders to optimize strategies before executing trades, enhancing confidence and efficiency. Users can assess the effects of various filters, including volume, imbalance, momentum, pivots, and wave patterns, as well as their choice of indicators, allowing for more informed decision-making.

See pricingOpposite Signal Execution. Lock in Gains or Minimize Losses.

B4 CoPilot Pro offers traders a variety of strategic options for managing their positions when executing trades based on opposite signals. This flexibility enables tailored responses to market conditions and enhances overall trading effectiveness.

Exit:

- Close the current position entirely, realizing any profits or losses.

- This option is ideal when the market signals a complete trend reversal, allowing traders to lock in gains or minimize losses.

Reverse:

- Immediately switch the current position to the opposite direction.

This approach capitalizes on the anticipated market reversal, enabling traders to profit from both the existing trend and the new direction.

Breakeven:

- Adjust the stop loss to the entry point, ensuring that no losses are incurred on the trade.

- This strategy protects profits while allowing for the possibility of further gains if the market continues to move favorably.

None:

- Maintain the current position without making any changes.

- This option is suitable for traders who wish to stay in their existing trade and ride out the market fluctuations without intervening.

B4 CoPilot Pro's opposite signal execution options empower traders to make strategic decisions that align with their market outlook and risk management preferences, ultimately enhancing their trading performance.

See pricingB4 Footprint Pro: Advanced Order Flow Analytics for Discerning Traders

B4 Footprint Pro is the definitive tool for traders seeking unparalleled insight into market dynamics. Engineered with cutting-edge order flow analytics, this professional-grade indicator delivers a granular, real-time view of market sentiment, volume distribution, and order placement—allowing you to see beyond price action and uncover the market’s underlying drivers.

Designed exclusively for NinjaTrader 8, B4 Footprint Pro integrates seamlessly into your workflow. Whether identifying potential reversals, gauging market depth, or pinpointing strategic entry and exit levels, it equips you with critical intelligence to stay ahead of market moves.

Core Philosophy: Less Is More

B4 Footprint Pro focuses on essential order flow data at each price level—presented with clarity and without overwhelming detail, empowering you to make fast, informed decisions.

Enhanced Order Flow Visualization

Transform traditional candlestick charts into precise volume footprint style charts, highlighting the volume distribution across individual price levels within each candle. Adaptable to a variety of candle styles, this approach significantly sharpens your market analysis.

Key Candle-Level Features

-

Point of Control (POC): Identifies the price level with the highest traded volume within each candle.

-

Value Area High (VAH) & Value Area Low (VAL): Automatically calculated active trading range levels, highlighting where the majority of volume occurred.

-

Stacked Imbalances: Configurable and color-coded to visually separate bullish (buying pressure) and bearish (selling pressure) imbalances, providing a clear picture of order flow dominance.

Automated VPOC Levels for Support, Resistance, and Breakouts

B4 Footprint Pro automatically projects VPOC levels—key price levels derived from the Point of Control—that act as critical support and resistance. These levels highlight liquidity concentrations where price reactions commonly occur, offering traders clear reference points for breakout and reversal opportunities without manual input.

Advanced Market Context Tools

-

B4 OrderFlow Volatility Bands: Proprietary bands designed to detect consolidation areas, signaling high-probability breakout opportunities.

-

L2 Profile: Positioned on the chart’s right edge, this visual order book profile exposes high-volume nodes and potential market manipulation (e.g., spoofing), enabling volume profile-savvy traders to detect pivotal liquidity levels.

Comprehensive Footer Insights

-

Delta Divergence Row: Monitors divergence between price action and delta to highlight potential reversal zones—spotting early trend shifts where buying/selling pressure conflicts with price movement.

-

L1 Sentiment Row: Reflects immediate order flow sentiment from active market orders, helping to gauge short-term momentum and market strength or weakness.

-

L2 Sentiment Row: Reveals resting orders in the order book to provide deep insight into market depth, crucial for identifying key support/resistance levels.

-

Volume Footer: Tracks total traded volume, confirming price movement strength by correlating volume intensity with price action.

B4 Footprint Pro’s automated VPOC levels, combined with comprehensive order flow analytics, provide clear, actionable insights that empower traders to identify and act on support, resistance, and breakout levels with precision and confidence.

See pricing

DISCLAIMER

Trading or investing in financial markets—including, but not limited to, futures, forex, equities, and cryptocurrencies—carries substantial risk and may not be suitable for all investors. An investor could potentially lose all or more than their initial investment. Risk capital refers to money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading, and only inspaniduals with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of

future results.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

This presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account. Participating in live trading rooms involves significant risks and may not be suitable for all investors. The information provided is for educational purposes and should not be considered investment advice. Participants are solely responsible for their trading decisions, and past performance does not guarantee future results. The trading room aims to teach trading strategies, market analysis, and risk management techniques, with all trades discussed being examples or simulations. There are no guarantees of trading outcomes as market conditions can change rapidly. Users must conduct themselves respectfully, and any inappropriate behavior, spamming, or unauthorized solicitation will lead to removal.

View CFTC advisories as they contain more information on the risks associated with trading virtual currencies.

Strategy Settings Disclosure for Educational Use Only

Strategy settings are provided for educational purposes to demonstrate trading methodologies, which may not suit every trader's goals, style, or risk tolerance. Users are encouraged to customize and backtest strategy settings in a demo environment before applying them to live trading. Adjustments may be necessary based on individual preferences and market conditions. Performance can vary due to market conditions, execution, or user implementation, and results from backtesting or simulations may not reflect live trading outcomes. Strategies must be actively monitored and adjusted as market conditions evolve, and regular evaluation is essential for consistent performance. All strategies include risk management tools such as stop-losses, take-profit levels, and position sizing. Users should ensure these settings align with their account size and risk tolerance, as improper risk management may lead to substantial losses.

TopTech Digital LLC, B4 Signals, and their team members are not registered financial advisors and do not possess the qualifications to offer financial advice.

TopTech Digital LLC, B4 Signals, and their team members will never manage or offer to manage financial accounts, whether for options, stocks, currencies, futures, or other securities. If anyone claiming to represent B4 solicits funds or account management services, please do not provide any personal information and contact us immediately.

TopTech Digital LLC, B4 Signals, and their team members are not liable for any losses incurred by users of their trading strategies or tools. Stop-loss strategies may fail to be effective due to market conditions (such as slippage) or technological issues that may hinder execution.

Trademark Disclaimer

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.

Thinkorswim® is a registered trademark of TD Ameritrade IP Company, Inc. No affiliation, interest, ownership, or endorsement exists for any product or service mentioned.

TradingView® is a registered trademark of TradingView, Inc. No affiliation, interest, ownership, or endorsement exists for any product or service mentioned.